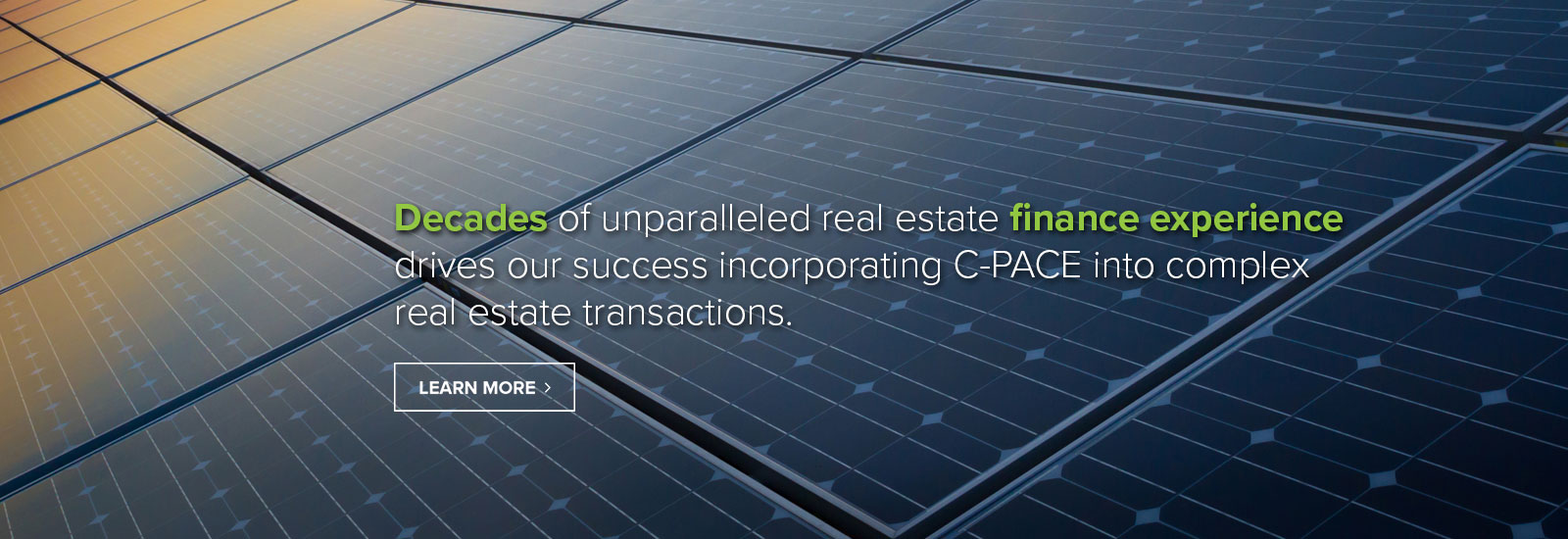

INVESTING IN A GREEN FUTURE WE ARE A LEADING CAPITAL PROVIDER FOR PROPERTY ASSESSED CLEAN ENERGY

Inland Green Capital LLC (“IGC”) is an environmental finance and investment company that provides capital for Property Assessed Clean Energy (PACE) project initiatives nationwide. IGC works with commercial property owners located in PACE programs across the country to finance clean energy improvements that enhance sustainability of their properties, lower both operating expenses and their cost of capital, and ultimately create value.

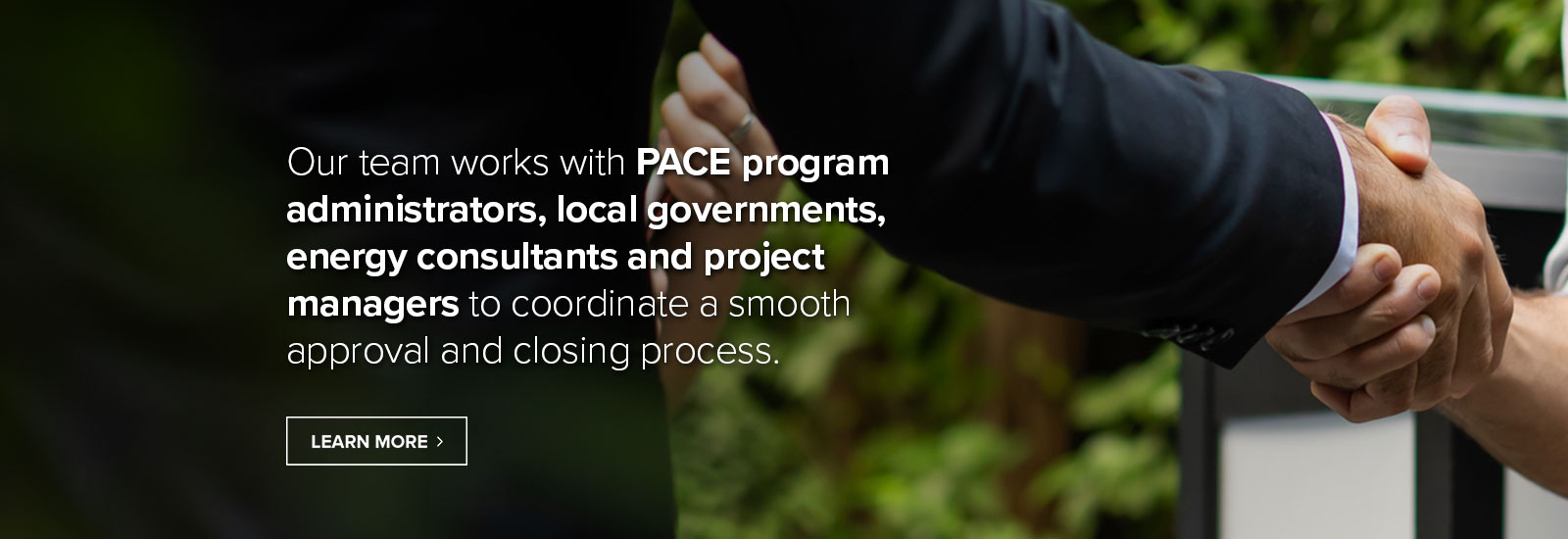

Inland Green Capital collaborates with real estate owners, developers, contractors, and local governments to achieve enduring clean energy and sustainability benefits.

BENEFITS OF C-PACE

Commercial Property Assessed Clean Energy (“C-PACE”) financing available through Inland Green Capital stimulates investment in clean energy and resiliency building improvements by delivering the following benefits:

Preserve Internal Funds

- Up to 100% financing of eligible C-PACE Project costs conserves working capital and preserves owner’s equity for other purposes.

Lower Cost of Capital

- Replaces equity and mezzanine debt with non-recourse, long-term (up to 30 years), fixed-interest financing at a fraction of the cost.

Increase Property Value

- Improves your collateral, reduces operating costs, and increases property values.

Achieves Clean Energy & Sustainability Goals

- Creates a business case for completing clean energy improvements that improve occupant experience and extend a building’s lifespan.

Transfers on Sale

- C-PACE assessments “run with the land,” therefore C-PACE financings stay with the property upon a sale.

Share Cost & Benefits with Tenants

- Property owner may pass through C-PACE assessment payments to tenants (if allowed by the lease agreement).

Off Balance Sheet Treatment

- C-PACE may qualify for off balance sheet treatment (consult your accounting advisor)

The Inland Green Capital C-PACE Process

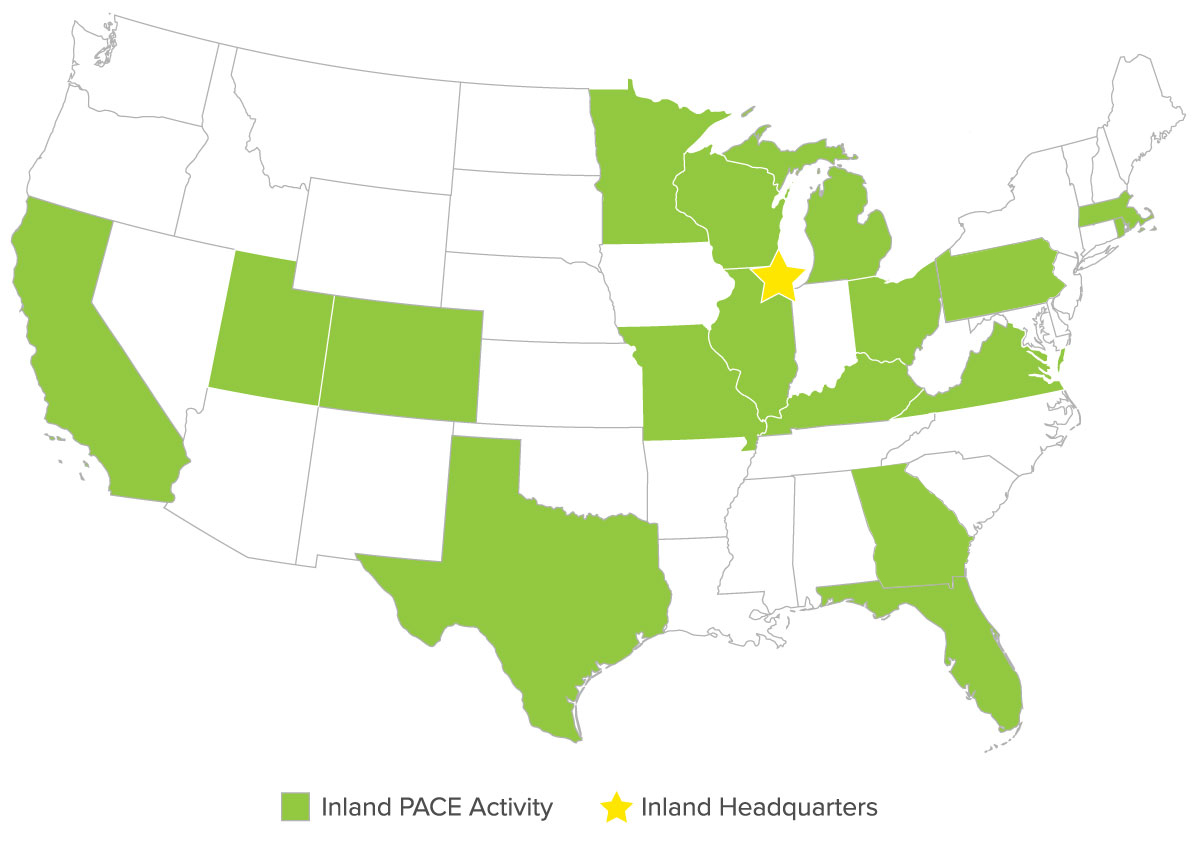

WHERE WE WORK

Ability to work in all U.S. C-Pace Markets